Protecting Family Farms

House Republicans have made continuous efforts to reduce or eliminate the burdensome ‘Estate Tax,’ known also as the ‘Death Tax,’ with more than a half-dozen bills introduced since the Spring 2023 legislative session. And despite Gov. JB Pritzker stating that reducing the estate tax was one of his ‘shared priorities,’ Democrats’ have yet to address any legislation that would protect family farms.

An estate tax, or inheritance tax as it is known in other states, is a tax paid by the estate of a deceased person after all debts to the private sector have been paid. In the states like Illinois where it is a law, payment of an estate tax is an essential part of the probate process. In estate tax law, the exclusion amount is an amount that is not considered when an estate is being taxed. The Illinois Estate Tax is a sliding-scale tax on probationary estates, and the tax cannot be levied on that part of an estate that is excluded. The current $4 million State of Illinois Estate Tax exclusion amount was enacted in December 2011 for persons dying on or after January 1, 2013. Prior to this enactment, the Illinois exclusion amount was $2 million.

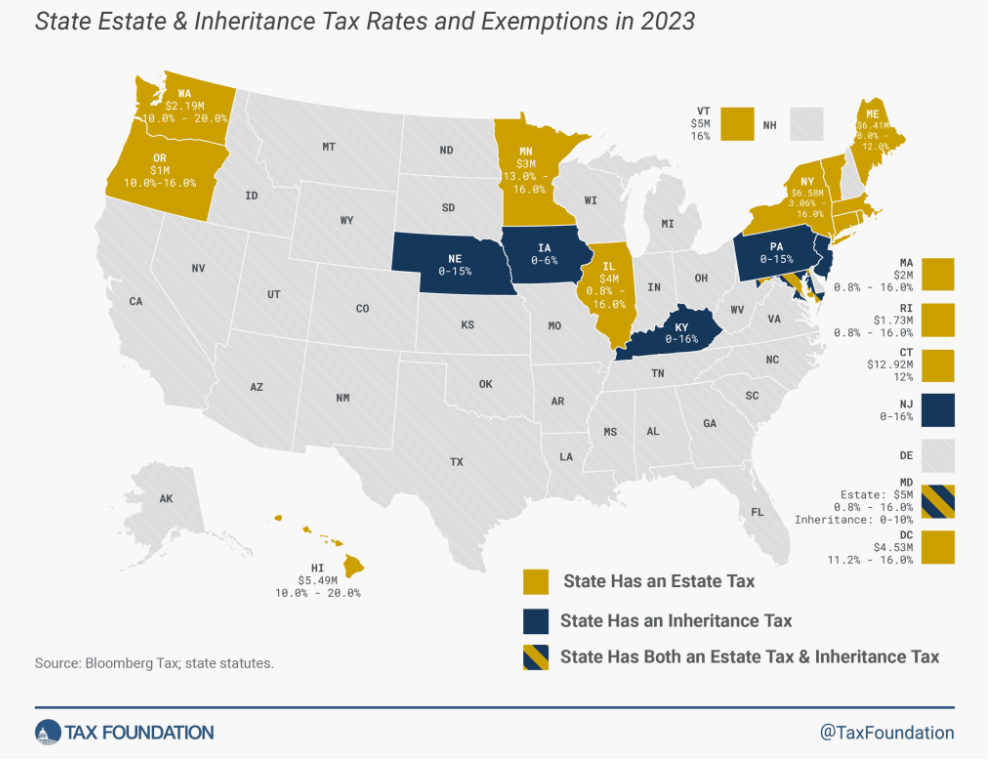

By contrast, the federal exclusion amount is indexed to inflation, though. It was $12.06 million in 2022 and that amount has gone up to $12.92 million in 2023. Unless there are further changes to federal estate tax law, that exclusion amount is scheduled to be cut in half in 2026 due to a quirky feature in the law that sunsets the current indexation. Currently, only 17 states charge an estate/inheritance tax, and 33 do not. Iowa is in the process of phasing out its inheritance tax by 2025.

Nearly 70,000 families own and operate 96 percent of the farms in Illinois, and all of these families are faced with questions when it comes to succession or transition plans for the business. The looming effects of the estate tax can force families to address future plans through gifting, discounting, leasing or some other method.

The threat for family farms and small businesses to either shutter or leave the state due to the estate tax is real. Several states that border Illinois, such as Indiana, Missouri and Wisconsin, do not charge an estate or inheritance tax, and Iowa’s is being phased out.

Research indicates that every year, Illinois farmers have to sell acreage and business owners have to sell company assets because a disability or death occurs. A farm or family business should not be at risk of being lost due to the estate tax.

Sign a Petition to Protect Family Farms